Table of Contents

Business Value Management

What is Business Value Management? We surveyed 39 CIOs to learn how the concept is currently seen and applied.

Survey Results

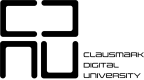

Industry Distribution

Especially Industrial Manufacturing and Banking and Financial Services are represented in this survey. Other industries are evenly distributed.

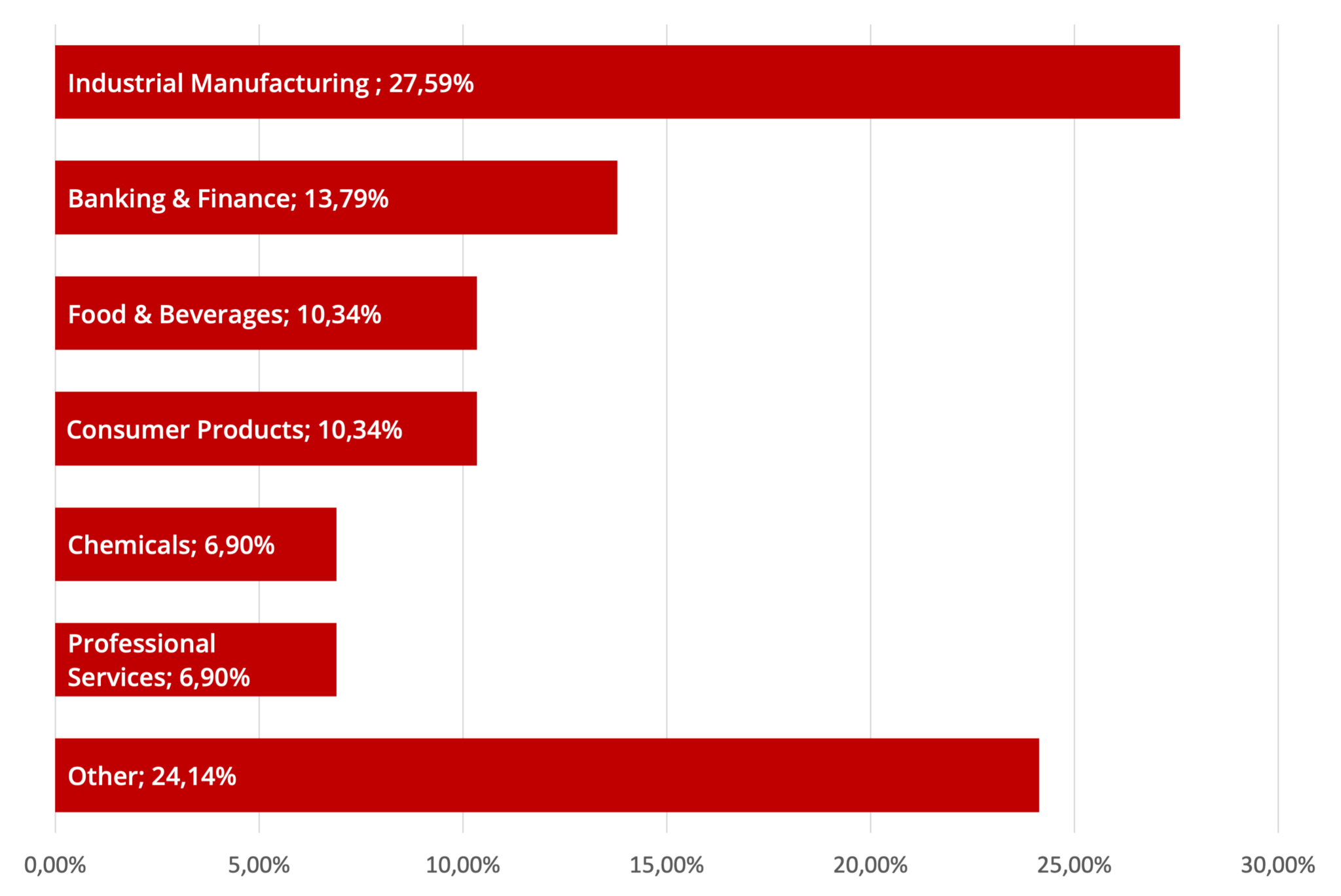

Sizes of Surveyed Companies

CIO-rated Relevance

On average, surveyed CIOs rate the relevance with 84/100 as very high. The CIOs see a relevance-discrepancy when comparing their perspective to that of the remainder organization.

Company Relevance

Business Value Management is well- resonated within organizations. However, the individual responses show a relevance-discrepancy: 54% of CIOs answer that their organization would rate it significantly lower (gap of 20% or more per individual answer).

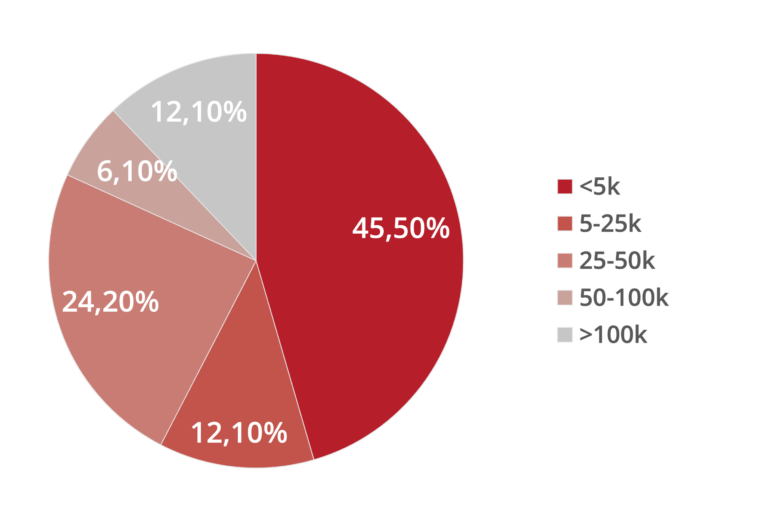

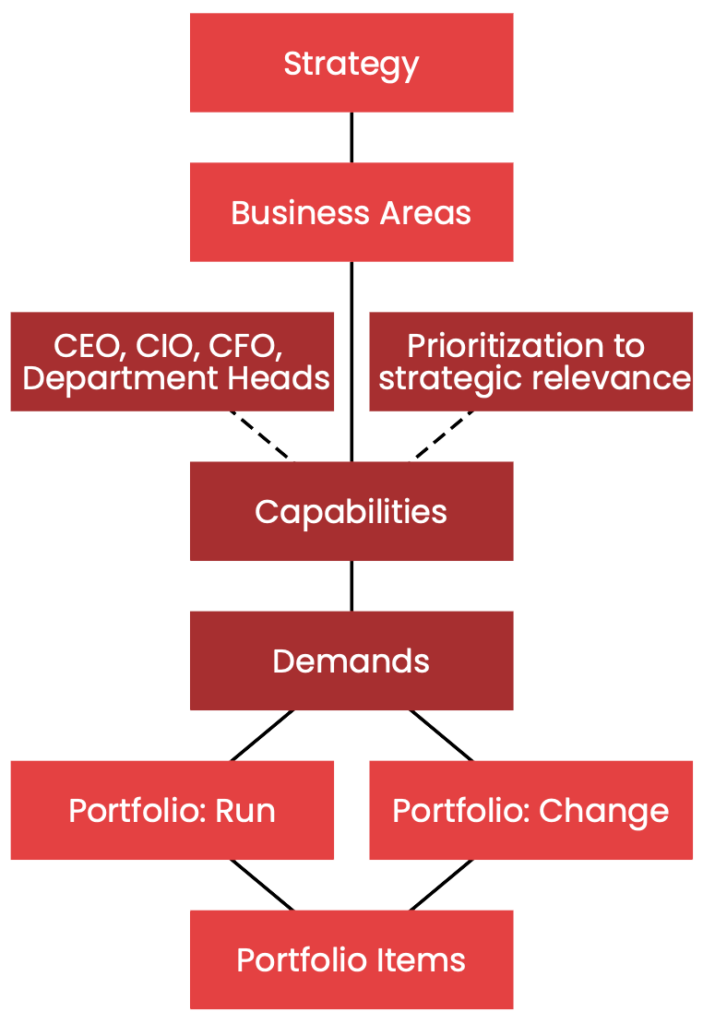

Involved Roles

The dialogue is driven by the CIO, CEO, and CFO. In larger organizations with more than 5k employees, department heads are also involved. The involvement of portfolio item responsible parties depends on the concepts being discussed.

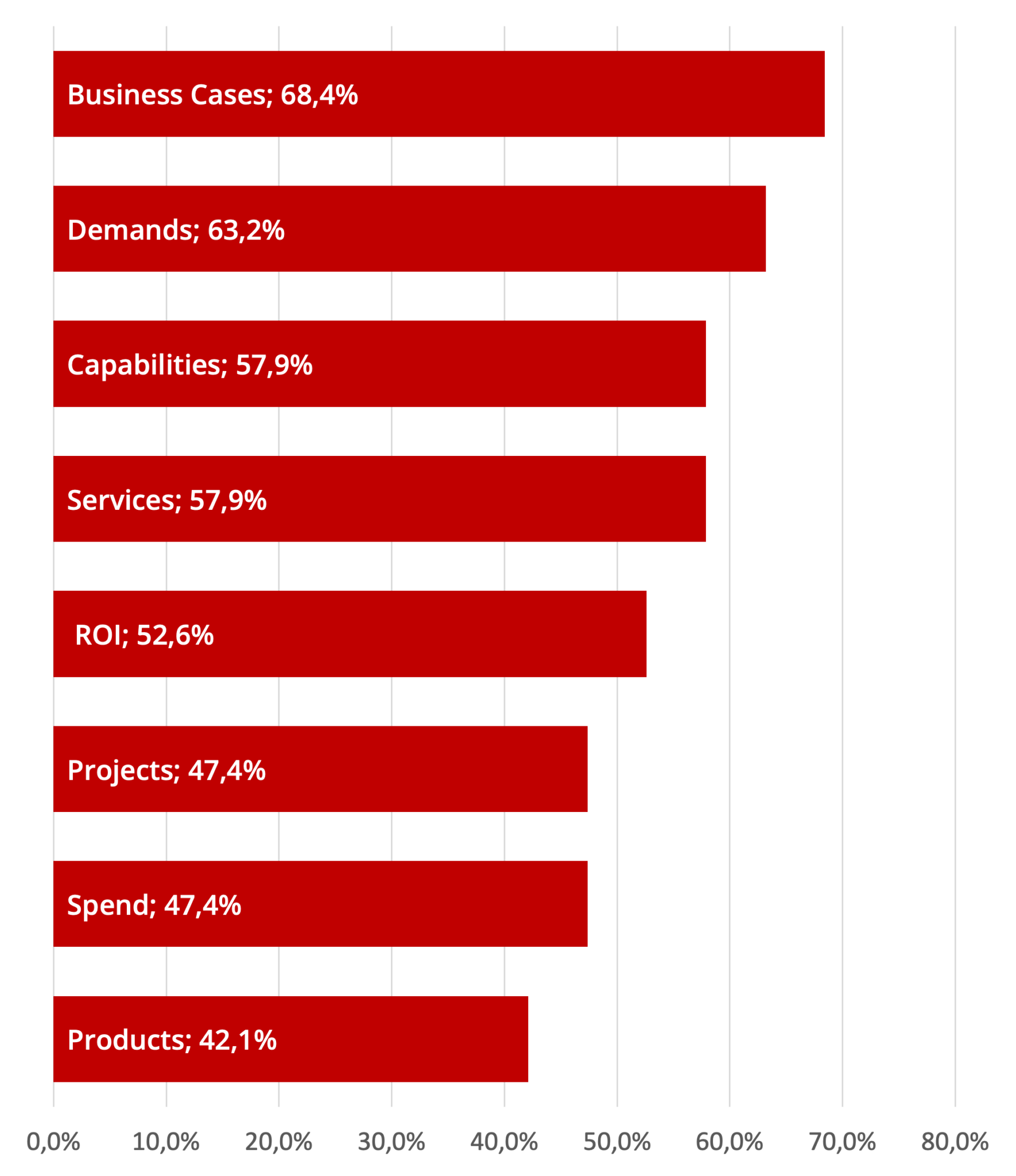

Related Concepts

What's Next?

Capability-Driven Model

In this version, capabilities are derived from the strategy and categorized as differentiators, enablers, or efficiency enhancers. Their categorization affects how business value is calculated, e.g. through business cases in efficiency scenarios or faith-based investments in the case of differentiators.

Prioritization involves all parties involved in the dialog and is done at eye level. Demands can be defined by the organization or derived from capabilities.

Overall, capability-driven business value management is primarily driven by strategy from the top down, with an internal and external perspective on the organization. (Inspired by dialogs with Prof. Rentrop)

Demand-Driven Model

In this version, demands are determined based on internal needs and often correlated with their proximity to the strategy and estimated size in person-days. The size is used to prioritize, with larger items ranked higher. Capabilities are used to categorize and bundle requirements instead of targeting processes (see also Melville et al. 2004). Business value is measured using the organization’s standard, such as by calculating Business Cases based on demands.

Overall, demand-driven business value management is primarily driven from the bottom-up with a focus on identifying business needs. (Inspired by dialogs with Bee360 Customers)

If you agree with what we’ve found and want to take action, let’s get in touch. Let us know which model – capability-driven or demand- driven – is better for your business. Let’s talk about what’s preventing your company from successfully leveraging business value and how we can help you get to the next level! There are many great concepts out there, but they mean nothing without implementation. Contact (external link).

About the Authors

Dr. Corvin Meyer-Blankart

Sönke Claussen